There are numerous measures to consider when thinking about the health of the farm economy. In earlier posts, we’ve written about net farm income, key financial measurements, and farmland values. The Kansas City Federal Reserve Bank surveys commercial agricultural lenders quarterly to glean insights about the farm economy from the perspective of agricultural lenders. This week’s post reviews the Kansas City Fed’s data on farm loan delinquencies.

Non-Real Estate Loans

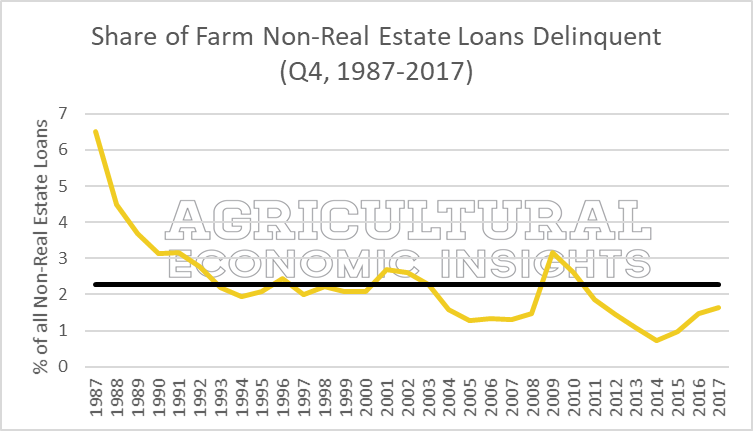

Farm loan delinquency data are split into two categories: non-real estate and real estate loans. The share of non-real estate farm loans that are delinquent is shown in figure 1. More precisely, these data are for the fourth quarter of the respective year, allowing for meaningful comparisons across years while avoiding issues with seasonality.

The share farm non-real estate loans that were delinquent in the fourth quarter of 2017 was 1.65%. This was higher than the 2016 rate of 1.47%, and more than double 2014 levels (0.72%). While a headline noting farm loan delinquencies doubling in three years would be alarming, it’s worth considering the starting point. Farm delinquencies on non-real estate loans were at record-lows in 2014. Furthermore, current rates are below the average of data since 1987 (2.27%). In fact, current delinquency rates are among the lowest in more than 30 years. Historically, delinquencies have been lower than current levels only 10 out of the last 31 year, or 32% of the time.

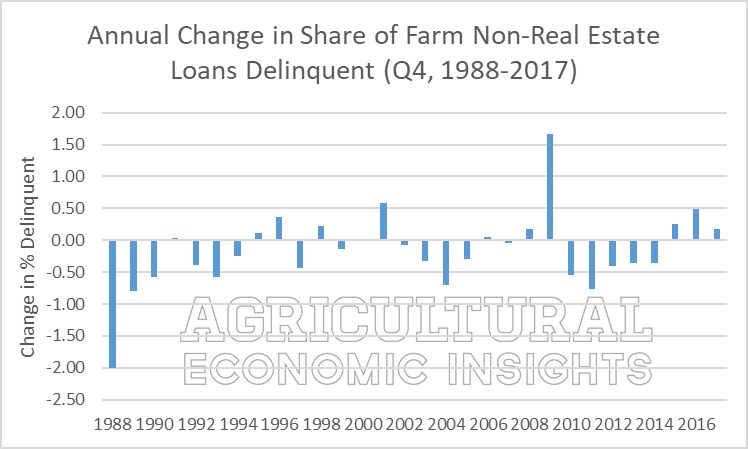

Figure 2 shows the change in the annual share of non-real estate farm loans that are delinquent. The reported data are percentage point changes. For example, the change from 2016 (1.47%) to 2017 (1.65%) was +0.18 percentage points.

These data provide two key insights. First, the annual change in the share of delinquencies was slower in 2017 than the recent years. In 2016, the measure increased 0.49 percentage points. The increase was much slower in 2017 (0.18 percentage points). Second, these data show that while non-real estate farm loan delinquencies are currently low, this can change rapidly. In 2009, the share jumped 1.67 percentage points. Such a jump in today’s farm economy would be concerning.

Figure 1. Share of Farm Non-Real Estate Loans Delinquent, Q4: 1987-2017. Data Source: Agricultural Finance Databook, Kansas City Federal Reserve Bank.

Figure 1. Share of Farm Non-Real Estate Loans Delinquent, Q4: 1987-2017. Data Source: Agricultural Finance Databook, Kansas City Federal Reserve Bank.

Figure 2. Annual Change in Share of Farm Non-Real Estate Loans Delinquent, Q4: 1988-2017. Data Source: Agricultural Finance Databook, Kansas City Federal Reserve Bank.

Farm Real Estate Loans

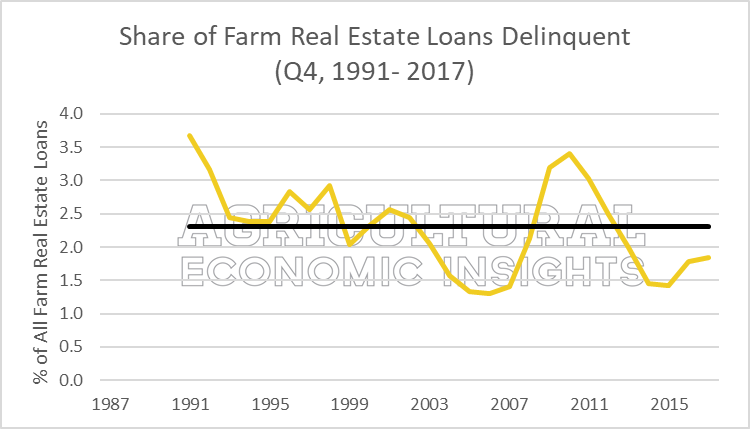

Data for real estate farm loan delinquencies, available since 1991, tell a very similar story (Figure 3). In 2017, the share of farm real estate loans delinquent reached 1.85%, up from recent years. The recent increase is, again, from historically low levels. Furthermore, current farm real estate loan delinquencies remain below the 26 year average of 2.3%.

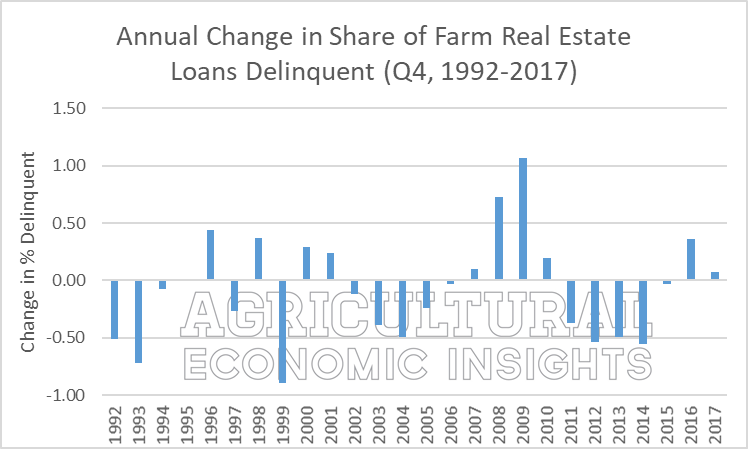

Again, similar to the non-real estate loans, the annual change in farm real estate delinquencies in 2017 was smaller than in 2016. In 2017, the measure increased by only 0.07 percentage points. In 2016, delinquencies increase by 0.36 percentage points (Figure 4). Historically speaking, large annual changes – greater than 1 percentage point in a single year- are not out of the range of possibilities.

Figure 3. Share of Farm Real Estate Loans Delinquent, Q4: 1991-2017. Data Source: Agricultural Finance Databook, Kansas City Federal Reserve Bank.

Figure 4. Annual Change in Share of Farm Real Estate Loans Delinquent, Q4: 1992-2017. Data Source: Agricultural Finance Databook, Kansas City Federal Reserve Bank.

Figure 4. Annual Change in Share of Farm Real Estate Loans Delinquent, Q4: 1992-2017. Data Source: Agricultural Finance Databook, Kansas City Federal Reserve Bank.

Wrapping it Up

When considering farm loan performance, a few key insights emerge. First, farm loan delinquencies have turned higher in recent years. This likely isn’t a surprise given the fall in commodity prices and farm income.

Second, even though the share of loan delinquent has recently increased, current levels remain on the low range of historical observations. Specifically, the current rate for both non-real estate and real estate loans remain below the long-run average. Most of this is attributable to a strong farm economy heading into the current slowdown. The starting point matters.

Finally, the situation can quickly change. Even though the share of farm loans delinquent is below levels seem throughout most of the 1990s and early 2000s, conditions can change rapidly.

Interested in learning more? Follow the Agricultural Economic Insights’ Blog as we track and monitors these trends throughout the years. Also, follow AEI on Twitter and Facebook.

Photo Source: Flickr/The Federal Reserve Bank of Kansas City